At Asset Retrieval Advisors, we specialize in helping individuals and entities recover unclaimed shares, stocks, and dividends from the Investor Education and Protection Fund (IEPF). If you are one of the millions of shareholders who have forgotten or lost track of your unclaimed assets, we are here to guide you through every step of the IEPF claims process. Our experienced team ensures a seamless, efficient, and hassle-free recovery of your IEPF shares, unclaimed dividends, and other securities that have been transferred to the IEPF due to non-encashment of dividends or due to death cases over the years.

In this comprehensive guide, we will walk you through the IEPF claims process, explaining each stage in detail, and outlining how we can help you claim shares from IEPF or recover your unclaimed dividend from IEPF. Whether you are looking to recover IEPF shares or get back lost dividends, we are here to make the process as easy and straightforward as possible.

What is IEPF (Investor Education and Protection Fund)?

The Investor Education and Protection Fund (IEPF) is a government initiative under the Ministry of Corporate Affairs (MCA) created to protect investors’ interests. The fund holds assets such as unclaimed dividends, shares, debentures, and other securities that have remained unclaimed by the rightful owners for a specified period, usually seven years.

When shareholders fail to encash their dividends or claim their shares, the companies are required by law to transfer those assets to the IEPF. This includes dividends that have not been claimed, as well as shares or securities that have remained unclaimed by their owners. The primary purpose of the IEPF is to safeguard these unclaimed assets and return them to the rightful shareholders when they come forward with a legitimate claim.

Why You Should File an IEPF Claim

If you have unclaimed shares or dividends, it is crucial to file an IEPF claim to recover these assets. If you don’t act, your shares or dividends may remain in the IEPF, out of your reach. By filing a claim, you regain control over your investments and ensure your rightful ownership of those shares or dividends.

Here are some reasons why filing an IEPF claim is important:

Recover Unclaimed Dividends:

If you have not encashed dividends over the years, these may have been transferred to the IEPF. Filing an unclaimed dividend IEPF claim allows you to recover these amounts.

Regain Ownership of Shares:

If your shares have been transferred to the IEPF due to inactivity, IEPF shares recovery will allow you to regain ownership.

Secure Your Financial Future:

By recovering unclaimed shares and dividends, you can potentially increase your financial assets and reinvest them in lucrative opportunities.

Avoid Missing Out:

While unclaimed shares and dividends do grow and generate value if left in the IEPF but in case there is a need they cannot be used. A timely claim ensures you to have access of your legitimate wealth, when needed.

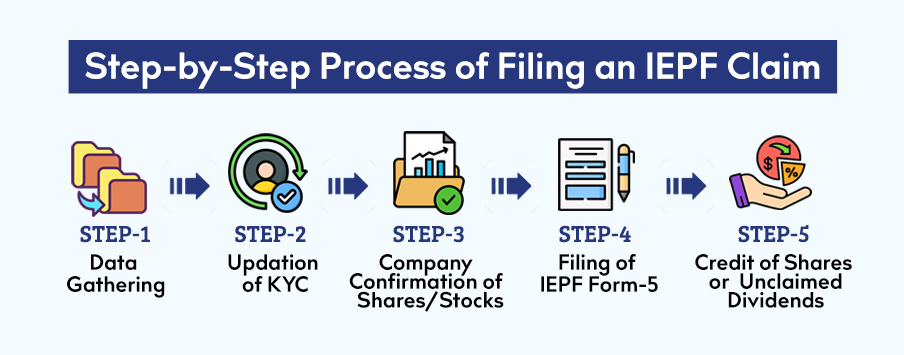

Step-by-Step Process of Filing an IEPF Claim

The IEPF claims process involves several stages, each requiring detailed documentation and compliance with regulatory guidelines. At Asset Retrieval Advisors, we streamline this process for you, ensuring your claim is processed efficiently. Below is a detailed explanation of the steps involved in IEPF claims:

1. Data Gathering for Old Holdings

Before you can file an IEPF claim, the first step is to gather all relevant details about your shareholding and unclaimed dividends. This information is crucial for verifying your ownership and initiating the recovery process. What you will need is:-

- Folio Number: The folio number associated with your shareholding.

- Shareholding Details: The number of shares you hold and the companies in which you hold them.

- Dividend History: Information about any unclaimed dividends that may have been transferred to the IEPF.

- Personal Details: Your name, address, contact information, PAN (Permanent Account Number), bank details and demat account details.

2. Updation of KYC

The second step is updating your KYC (Know Your Customer) details with the relevant authorities. This ensures that the IEPF Authority has the most up-to-date information about your identity and shareholding status. Incomplete or outdated KYC details can delay the claim process. Documents required are:-

- PAN Card: A copy of your PAN card.

- Address Proof: A recent utility bill, Aadhaar card, passport, or bank statement as proof of address.

- Bank Account Details: A canceled cheque or passbook showing your bank account details for the dividend credit.

- Demat Account Details: Client Master List having all the details related to your Demat account.

3. Company Confirmation of Shares/Stocks Holdings

Once you’ve updated your KYC details, the next step is to obtain confirmation from the company where your shares are held. You will need to verify whether your shares or dividends have been transferred to the IEPF.

- Contact the Company: Reach out to the registrar or transfer agent of the company.

- Obtain Confirmation Letter: Request an official letter from the company confirming that your shares or dividends have been transferred to the IEPF.

4. Filing of IEPF Form-5

Once you have the necessary information and confirmation, the next step is to fill out and file IEPF Form-5. This is the official application used to claim shares or unclaimed dividends from the IEPF.

- Form Completion: Complete the form accurately, providing all required details such as your shareholding information, company details, and confirmation from the company.

- Document Submission: Attach all relevant documents, including KYC proof, the confirmation letter from the company, and proof of your unclaimed shares or dividends.

5. Credit of Shares or Unclaimed Dividends to Your Demat Account

The final step in the IEPF claims process is the credit of your recovered shares or unclaimed dividends into your demat account.

- Shares Credit: Your recovered shares will be credited electronically to your demat account.

- Dividend Credit: Any unclaimed dividends will be transferred to your bank account linked to your demat account.

- Final Confirmation: Once the shares or dividends are credited, you will receive confirmation from the company or your depository participant.

Why Choose Asset Retrieval Advisors for Your IEPF Claims?

Navigating the IEPF claims process can be complex, but with Asset Retrieval Advisors on your side, you have expert guidance at every step. Our team brings years of experience and in-depth knowledge of the regulatory landscape surrounding IEPF shares recovery and unclaimed dividend from IEPF claims. Here’s why you should choose us:

Expert Guidance

Our experienced professionals help you navigate the complexities of IEPF claims, from gathering data to filing IEPF Form-5.

Timely Processing

We ensure that your claim is processed efficiently, minimizing delays and ensuring quick recovery.

End-to-End Service

From data gathering to the final credit of shares and dividends, we handle the entire process, ensuring a hassle-free experience.

Compliance Assurance

We ensure all your claims are fully compliant with IEPF regulations, reducing the chances of rejection.

Personalized Attention

We provide tailored solutions based on your specific needs, ensuring that your claims are successfully processed.

Common Challenges in the IEPF Claims Process

While the IEPF claims process is straightforward, there are common challenges that many claimants face. These include:

- Discrepancies in Shareholding Records: Sometimes, companies maintain outdated or inaccurate shareholder records, leading to difficulties in confirming the transfer of shares to the IEPF.

- Incomplete KYC Details: Outdated or incomplete KYC information can delay or prevent the processing of your claim.

- Documentation Issues: Missing or incorrect documents can cause delays in the approval of your claim.

- Delays in Processing: While the process can take time, delays are often due to incomplete or incorrect filings, or backlogs at the company or IEPF office.

Our team at Asset Retrieval Advisors is here to address these challenges and ensure that your IEPF shares recovery is handled as smoothly and efficiently as possible.

FAQs About IEPF Claims

The Investor Education and Protection Fund (IEPF) is a fund created by the government to hold shares, dividends, and other assets that have been unclaimed by their rightful owners for a specified period (typically seven years). These assets are transferred by companies to the IEPF for safekeeping until the rightful owner files a claim for recovery.

You can check if your shares or dividends have been transferred to the IEPF by contacting the company's registrar or checking the IEPF website. The IEPF Authority also maintains a list of unclaimed assets.

You will need to provide proof of identity (PAN, Aadhaar), proof of address, KYC documents, shareholding details, a letter confirming the transfer of shares to the IEPF, and any other documents related to the unclaimed dividends.

The timeline for IEPF claims can vary. Generally, it takes several weeks to a few months, depending on the accuracy of your documents and the processing time at the IEPF Authority.

Yes, if you have unclaimed dividends that were transferred to the IEPF, you can file a claim for the recovery of those amounts.

Get Started with Your IEPF Claims Today

Don’t let your unclaimed shares or dividends stay in the IEPF any longer. Asset Retrieval Advisors is here to help you recover your assets with ease. Our team of experts will guide you through every step of the IEPF claims process and ensure that your claim is processed efficiently and effectively.